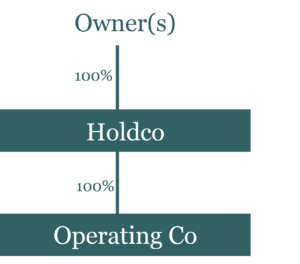

Tax Tuesday regularly encounters business owners who are not yet aware of the significant commercial protection which can be achieved through having a holding company (Holdco) put on top of their operating company (Opco). This week we look at how you could apply this uncontroversial, cost-efficient, and tax-free reorganisation to your business.

The way it works is the Holdco is inserted between the shareholders and Opco, and is duly followed by tax-free transfers of the business’ key assets up to Holdco. It is a commercial initiative which safeguards those key assets from future risks and allows the owners to sleep more easily, every night henceforth.

This week, a successful company supplying components to railway operators (and holding a material balance of undistributed cash), heard about the holding company facility and the owner now wants to implement it right away. By moving all of that surplus cash up to a new Holdco, they can know that the cash (it is cash in this case, but it is often property, IP, or plant and equipment) can be made safe from economic downturn, from claims for the consequences of faulty supply and from all the risks of being engaged in a busy trading operation. The money will still be fully accessible by the business, by inter-company loan at a moment’s notice.

The step plan is quite straight-forward:

- We form a new company which will become the new holding company (Holdco),

- We clarify the background and commercial objectives for Holdco (i.e. protection from future creditors and claimants) and we write to HMRC to obtain their approval for undertaking a tax-free reorganisation,

- We execute a “share-for-share exchange”, under which the owner’s existing shares in their operating company (Opco) are transferred to Holdco in consideration for an issue of shares to them by Holdco,

- We obtain separate clearance from HMRC that no Stamp Duty applies to the transaction,

- We establish a bank account in Holdco,

- We have the company resolve to declare a dividend which takes the surplus cash up to Holdco, all on a tax-free basis,

- We decide whether to establish a VAT registration for Holdco and, if so, whether to make that a group registration with Opco,

- We emerge with a small “group”, with key assets in the “top” and operations retained “downstairs”.

Those with claims against Opco can look for remedy to the assets within that company only – not those held above, or outside of, Opco’s ownership.

Pictorially, the position, post reorganisation, looks, very simply, like this:

You could achieve this form of reorganisation typically within six weeks, which includes 30 days for HMRC to consider the required clearance application.

The tax status of the owners’ shares in Holdco is identical to the tax status of the previous Opco shares – i.e. the new shares replace the old shares and all capital tax reliefs flow through (e.g. eligibility for Business Asset Disposal Relief and Business Property Relief).

More reasons to set up a new structure

- It opens up the possibility for any non-operational transactions to be undertaken away from your Opco, potentially achieving tax relief where they might not otherwise qualify as deductible costs associated within the Opco trade. Transactions in your Holdco can also afford greater privacy.

- The structure offers a choice for a future sale of your business. It can be a choice between a sale by the owner of Holdco shares (the “normal” choice) or a sale of Opco from out of Holdco. The latter option can be achieved free of taxation under what is known as the “Substantial Shareholding Exemption” and, although the gross proceeds received are then still within a company (Holdco), this can be advantageous to taxpayers in certain circumstances and with particular plans for their wealth.

So, the holding company reorganisation is a classic protection structure with other valuable features and benefits potentially achievable along the way. Additional costs of maintaining the structure basically involve an annual set of what are typically very simple accounts.

How can we help?

If you would like to discuss the prospect and benefits of a new holding company on top of your operating company, please email tax@haroldsharp.co.uk to discuss.